After spending the last three years duking it out for streaming subscribers, Disney lately has found itself involuntarily locked in a competition with Netflix to see which company can generate the most negative press. Every week seems to bring some new reason for industry writers and Wall Street analysts to take a shot at a company that, just three months ago, was being hailed for having kicked off the year with better-than-expected earnings and surging subscriber growth at Disney+. Since then, though, it’s been all downhill:

➽ Like Netflix, Disney has seen its stock price tank this spring (albeit somewhat less dramatically), prompting doom-and-gloom headlines about why “the magic is gone” and how the company is scrambling to “find a new story to tell” investors. After closing near $160 per share in mid-February, Disney stock has been on a steady slide — along with the rest of the market — and is now hovering around $95 per share.

➽ On top of the stock woes, Disney CEO Bob Chapek has become a punching bag for cultural critics. Political partisans on the left and right pummeled him over his response to Florida’s putrid “Don’t Say Gay” legislation — first for not speaking out in opposition to the bill and then for actually doing so. Florida governor and America’s Next Top Trump contestant Ron DeSantis took Chapek’s reversal and used it as an excuse to try to cancel one of the state’s biggest and most beloved companies. Theoretically, this should have made Chapek look good in Hollywood since the Disney boss did the right thing by denouncing a homophobic law. But because of the company’s initial wishy-washiness, the CEO seems to have gotten zero credit.

➽ Finally, last week, Chapek’s completely unexpected decision to summarily dismiss Disney General Entertainment chief Peter Rice sent writers at the Tinseltown trades (and upstart industry newsletters) rushing for their respective fainting couches over the horror — the absolute horror! — that a nice guy like Rice would be treated so shabbily. You’d have thought nobody in the town had ever been fired without just cause or that somehow top execs putting their own stamps on their leadership teams was some novel development. As one industry insider sympathetic to Chapek’s plight puts it, “The Hollywood press has decided what their narrative is about him, and they’re just not giving him a break.”

This is a newsletter about the streaming business, not one focused on the soap opera–like drama that goes on at the top levels of giant conglomerations. My opinion on whether Chapek is doing a great job managing the entire Walt Disney Company is: Ask somebody else. But streaming is now the heart and soul of Disney and most other big media companies. And if you’re just looking just at that part of his portfolio, then Chapek deserves much more credit that he’s gotten — even when it comes to the sacking of Rice.

It’s true that by all accounts Chapek had no problem with how things were going inside all the divisions Rice oversaw — basically, all TV-content creation at Disney that’s not ESPN, Star Wars, or Marvel. Instead, according to multiple published reports and insiders I’ve spoken with this week, Chapek simply didn’t think Rice was enough of a team player or the right fit for where Chapek was taking the company. “He wasn’t fired for cause; he didn’t do anything wrong. He just wasn’t doing the job the way his boss wanted it to be done,” one industry insider who knows many of the players involved in the drama says. “It’s a much less sensational story than what’s been written, but I think Bob simply didn’t like working with Peter.”

That may sound brutal, but it’s also something that happens all the time in the TV business, and Hollywood in general. Ask the dozen-plus very talented execs at WarnerMedia Discovery who’ve been shown the exits in recent weeks following the company’s merger with Discovery. They didn’t really even get the chance to prove themselves; they were just deemed either redundant or not right for the new team… and dismissed. By contrast, Chapek — who inherited Rice from his predecessor, former Disney CEO Bob Iger — waited two full years before making last week’s move. He even signed Rice to a new deal last fall, clearly indicating he wasn’t simply looking to make a change just to make a change.

Of course, handing Rice an expensive new contract and then dumping him less than a year later obviously raises the question of why Chapek didn’t act sooner, saving Disney a lot of money in the process. (Disney will likely have to pay Rice the full value of his contract.) I don’t pretend to know how Chapek makes decisions, but perhaps whatever issues he had with Rice simply took more time to crystalize, or given how much more challenging the streaming business has become in recent months, Chapek wanted to take action now to ensure his TV team was operating as smoothly as possible. And yes, it could also simply be that Chapek got tired of reading press accounts filled with whispers that Rice might be in line to replace Chapek as CEO should the Disney board lose confidence in him. That sounds far-fetched to me — Rice really doesn’t have the broad Disney experience needed to run the company — but nobody ever went broke betting on pettiness and insecurity as motivating factors in Hollywood.

Why Walden Works

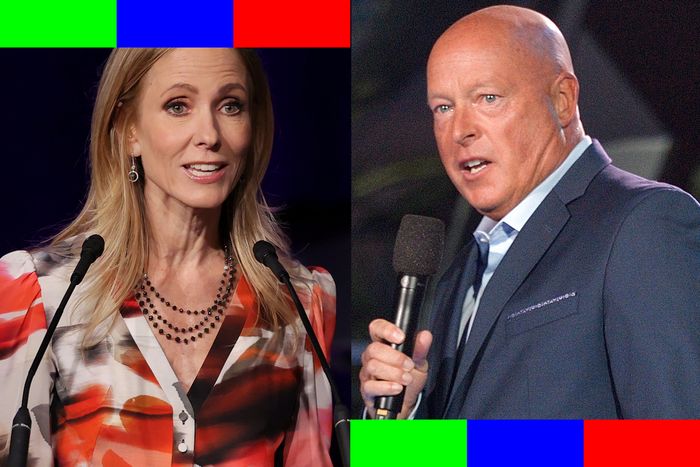

But I also think some folks analyzing the situation are overlooking one very big factor in Chapek’s calculations: Firing Rice is unlikely to do any material damage to Disney’s TV operations and might quite possibly help it run even more smoothly. That’s because Rice has been replaced by his longtime No. 2, respected industry vet Dana Walden. In all the stories that have been written about how well Rice’s TV units have been doing of late, what has gotten lost is that Walden — not Rice — is the exec most TV industry insiders would likely credit with those triumphs.

That’s not meant as an insult to Rice, who is indeed also very well-respected around town, and was an ally to many inside the Disney TV operation (particularly FX chief John Landgraf, who reported directly to Rice). But Walden has been far more involved in the transformation and strengthening of the company’s TV-production operations. Combining Hulu and ABC’s development and exec teams into one functioning unit? That was Walden. She also worked to clarify the content brands for the two platforms, figuring out what types of programs should debut on the broadcast network (family comedies, mainstream dramas, “shiny-floor” competition shows) and which made more sense for Hulu (limited series, Emmy-bait dramas). And while some of the recent media love letters to Rice have talked up how much top talent liked working with him, most of his relationships were on the film side. He didn’t even start working in TV until about a decade ago, when he was installed by Rupert Murdoch as Walden’s boss at Fox.

Walden, by contrast, has been toiling away in the small-screen salt mines for upwards of three decades, dating back to her days as a PR rep for Star Trek: The Next Generation, Arsenio Hall (really!), and what eventually became the Fox Broadcasting Corp. And her connections to showrunners such as Liz Meriwether (The Dropout), Danny Strong (Dopesick), and Lee Daniels (The Wonder Years) have led to some of Disney TV’s biggest successes of late. The exec also led the charge to get the Kardashians to set up their post-E! project at Hulu, resulting in the streamer’s biggest unscripted-series launch ever.

Given Walden has been carrying so much of the load at Disney TV already, there’s a logic to simply making her the main person in charge of the entire operation — particularly since her new role won’t necessarily add that much more to her plate. Ever since Rice lost control of content distribution at the end of 2020, the only big areas of his job which didn’t overlap with Walden’s were FX and ABC News, as well as overseeing the execs in charge of National Geographic and Disney Branded Entertainment (i.e., all the originals on Disney+ that aren’t from Marvel, Star Wars, or Nat Geo). While all those divisions make critically important content, they also won’t require Walden’s day-to-day attention. Landgraf, for example, is expected to continue to enjoy the same general autonomy he had for years under Rice.

The truly new challenge Walden will face in her new role is overseeing ABC News. Broadcast news divisions are notorious for leaks and gossipy items from unnamed staffers complaining about company “suits,” so the odds are high we’ll see stories in the coming months about whether Hollywood-savvy Walden has the “experience” to oversee news. But it should be noted that Rice didn’t have a TV news background when he took control of ABC News, nor did CBS CEO George Cheeks or NBCUniversal boss Jeff Shell. All three seemed to have handled the additional oversight just fine. Fact is, it seems unlikely Walden has any interest in meddling with the day-to-day at ABC News or implementing dramatic changes to a part of the company that’s actually been doing very well in recent years. Most likely, she will simply do her best to make sure ABC News president Kim Godwin feels supported and has the tools she needs to continue pushing the division into the streaming era.

As I noted earlier, Chapek’s critics around Hollywood (and among the reporters who cover the town and the entertainment industry) have been very vocal of late about their belief he’s not doing a great job running the company. Disney shareholders certainly aren’t loving the sagging stock. Other recent moves — like this week’s loss of cricket rights in India (more on that below) — may also end up being seen as a mistake. It is not far-fetched at all to wonder whether, six months or a year from now, Chapek will get the same sort of shock he delivered to Rice last week and end up unemployed himself.

But even if Chapek has done a bad job in some areas, I think describing his actions last week as yet another “disaster” or “blunder” is just flat-out wrong. Elevating the exec with the most experience and operational understanding of the creative side of TV to the top post at Disney General Entertainment should be seen as a win for creatives and other execs at the company. Dana Walden is someone who knows how mass-market shows get developed, produced, and marketed better than anybody else at Disney, and probably as well or better than anyone else in TV land. And now she is calling all the shots.

Disney’s Other Sticky Wicket

Another thing Disney and Netflix have in common is they’re both increasingly reliant on markets outside of North America and Europe to drive subscriber growth. India, with a population well in excess of 1 billion people, has become a particularly important part of the Disney+ story the past couple of years, accounting for over one-third of the platform’s worldwide subscriber tally. And a big reason so many Indian viewers have signed up for Disney+ is because the platform there, which is marketed as Disney+Hotstar, includes streaming coverage of the Indian Premier League cricket — or at least it did.

Earlier this week, while Disney did strike a deal for linear-TV rights to the IPL, it was outbid for the streaming rights to the league by Viacom18, a joint venture between Indian telecom giant Reliance Jio and Paramount+ owner Paramount Global. Starting next spring, that means millions of Indian Disney+ customers might decide to cancel their subscriptions.

A loss of upwards of 20 million subscribers is possible, according to some analysts; at the very least, it might make it impossible for the company to reach its stated goal of 240 million global customers by fall 2024. Anthony Crupi, who covers sports media for Sportico, says Disney ponying up for linear rights but not streaming is “truly a head-scratcher” to him. “Media-agency types who work the Indian market say that the Disney+ gains on the subcontinent — the service picked up 14.9 million new subs between April 2021 and April 2022, marking a 42 percent year-over-year gain — were ‘built on the back of cricket,’” he told me. “And 91 percent of Indian sports enthusiasts, or 124.2 million souls, are cricket fans. … Given that India was where all the growth was and represents the biggest chunk of sign-ups, they’re going to lose ground in a hurry.”

There is another side to this equation, however. As Crupi notes, Disney makes a mere 76 cents in average revenue per subscriber from Disney+Hotstar, which is “just 12 percent of the $6.32 ARPU generated via the D+ customers in North America,” which is why Chapek was able to pre-spin a possible loss of IPL during the last Disney earnings call. “While certainly [cricket] is an important component, that local content that we’re developing really will mitigate the impact,” Chapek predicted a few months ago. “It’s not like we see that business evaporating if we don’t get it.”

Note that Chapek said business: Because Disney doesn’t make a ton of cash from its Indian customers, it also won’t lose that much revenue if they disappear. Indeed, earlier this month, industry analyst Michael Nathanson of MoffettNathanson told the Wall Street Journal he was rooting for Disney to lose its bid for IPL rights because it would allow the company to set a more realistic subscriber goal. Plus, he noted, “It would indicate a focus on financial discipline and return on capital.”