Looks like Wesley Snipes’s take on J. Edgar Hoover might have to wait a while. TMZ reports that the 48-year-old actor has surrendered himself to authorities and is in transit to a federal prison to begin serving out his three-year sentence for federal tax evasion. “The defendant Snipes had a fair trial,” said U.S. District Judge Terrell Hodges in his ruling, which rejected Snipes’s last-minute request for a new hearing. “He has had a full, fair and thorough review of his conviction and sentence by the Court of Appeal; and he has had a full, fair and thorough review of his present claims, during all of which he has remained at liberty. The time has come for the judgment to be enforced.” [TMZ, E!]

For a complete history of the actor’s legal troubles, click on the slideshow below.

Snipes becomes acquainted with Eddie Kahn of American Rights Litigators, who tells the actor about the

“861 Argument,” which contortingly, nonsensically, and self-servingly interprets the U.S. tax code’s Section 861 to mean that income earned in America is exempt from taxation.

The IRS informs Snipes that he is under criminal investigation for tax evasion. In the years that follow, Snipes argues that he is a “stateless person,” a “nontaxpayer,” and a “nonresident alien,” and that he is not an “individual,” and he also occasionally inserts additional punctuation into his name as he feels this changes his legal status and makes him no longer subject to government authority. The government replies that,

according to GQ, “Snipes attempted to undermine not only the tax system but, on occasion, the fundamental codes of meaning we all share.” The government also finds some of the correspondence to be threatening.

Snipes is indicted for tax evasion.

Snipes, along with Eddie Kahn and Douglas Rosile, is charged with one count of conspiring to defraud the United States and one count of knowingly making or aiding and abetting the making of a false and fraudulent claim for payment against the United States. Snipes is also charged with six counts of willfully failing to file Federal income tax returns by their filing dates.

Snipes declares that he is not a U.S. citizen and that the government has no right to tax him or punish him for not paying taxes. Five days later, he pleads not guilty to the charges against him.

The trial begins. Almost three weeks later, Snipes is acquitted of the most serious charges levied against him but is convicted of three lesser charges.

He is found guilty of failing to file returns or pay taxes from 1999 through 2001 and is ordered to pay $17 million in back taxes, including penalties and interest

A judge sentences Snipes to three years for tax evasion. The penalty is the maximum allowed.

The judge in Snipes’ tax evasion case rules that he can remain free on bail until after his appeal has been heard, though on July 16, the appeal is denied.

Snipes files documents calling for a new trial.

He claims that three of the jurors had decided he was guilty before hearing any evidence and that the government should have disclosed that Kenneth Starr, a key witness against Snipes, was being investigated for involvement in criminal activities.

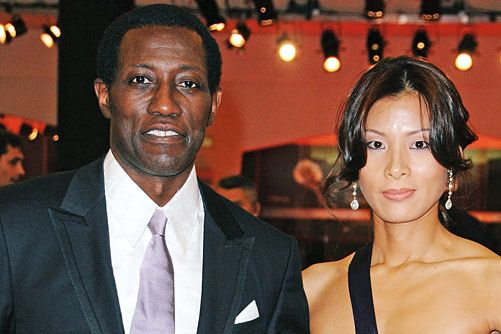

Snipes turns himself into authorities and in transported to federal prison. Earlier in the day, a judge had ordered him to surrender.

Nikki Snipes, Wesley’s wife, writes a six-page screed to friends and family blaming the government and the media for her husband’s troubles.

She writes that he has been “wronged in a way that i thought only existed in the movies.”