When I first met Inigo Philbrick in 2012, he was all of 25, looked an awful lot like Justin Timberlake, and was running an art gallery called Modern Collections in London’s Mayfair district. Despite sounding like a spinoff of Bed Bath & Beyond, it was backed by the astute and prescient art insider Jay Jopling, who’d founded White Cube gallery and helped give the world the careers of Tracey Emin and Damien Hirst — for better or worse. I was immediately smitten, professionally and personally; Philbrick was sharp, fun, and funny.

He was slim, neither short nor tall, with closely cropped gingerish curls and carefully manicured stubble to the point just shy of reaching a fully fledged beard. He was American but vaguely posh accented, with an English-educated art-museum-curator father, Harry Philbrick, whom he’d followed to Goldsmiths, University of London, as a fine-arts student. The sort of person who fit in seamlessly among the well-educated, well-tailored, well-traveled tribe that populates the art world, even if, unlike so many of them, he didn’t happen to have the inherited funds. Already, however, he had the airy arrogance and profound self-assuredness you find in the smoothest and most convincing of art dealers.

And for a long time, I thought that was one of the most fortunate days of my life, since, soon after I bought a Nate Lowman painting from Modern Collections, we became friends and art-world wingmen for each other in life and business. Though I’d been making art, teaching, and curating as well as buying and selling art at auction and brokering sales between art dealers for more than 20 years by then, the last eight while living in London — all the while writing about the trade from an insider’s perspective — I’d never made all that much money off it all. The art world seems like it’s flooded with dough, and it is, but its best-publicized assets (pricey name-brand artworks) are for the most part bid up and exchanged among a rather limited number of people, most of whom are already deeply entrenched in the market. It’s a game easy to gawk at but not as easy to be dealt into. And Philbrick was determined to be a player.

For a few years, we drank a great deal of very expensive wine and ate obscenely priced sushi rolls. We took trips together: New Year’s in St. Moritz, summers in Spain (not Ibiza; he was too busy, he told me, when he was with the “clients” he never wanted me to interact with), and art trips to Dijon, Milan, Paris, and even Crystal Bridges in Arkansas, frequently on jets he’d chartered for the occasion. Between competing for steps on the iPhone Health app and drinking institutional amounts of red wine and Monkey 47 gin, we talked shop. We were friends. We loved art. He was a key source of information for my column on Artnet; a character I invented called Deep Pockets was an amalgam of insiders but primarily Philbrick. My kids would always say, “Inigo is either the next Larry G. [Gagosian] or a future jailbird,” years before any major red flags arose — little geniuses that they are.

Friends would accuse me of loving him, and I can’t deny that. Not in a physical way so much, though there was admittedly a lot of horsing around, especially under the influence, which we often were. He’d frequently slip my glasses on when I’d remove them to text. He even grabbed me once following an afternoon consumed by consuming a few bottles and put me into a violent bear hug on a London street corner that I had to struggle my way out of.

Through all of this, he helped me make a good deal of money, I’ll admit. He’d sell me, say, a Christopher Wool work on paper for around $800,000 or a Rudolf Stingel on canvas for around a million dollars, then he’d resell it to another client and we’d both pocket a few hundred thousand. Philbrick sauntered into the salesrooms like a seasoned veteran beyond his years with balls of steel. I used him to get access to evening auction tickets, as I was blacklisted from time to time for my writing, and he liked the breadth of my experience and the profile that my writing enjoys. As recently as December 2018, I wrote on Artnet News that “the young dealer … has kept a low profile as a secondary trader well known among the cognoscenti for being shrewd and having a mind of his own … a rarity in the market.”

I didn’t realize how he might be in over his head — or the extent of it — until six months or so after I wrote that. It was around then that he was accused of selling art that wasn’t his to sell in elaborate transactions and trying to hide that even more elaborately. Philbrick, it seemed, was a mini-Madoff of the art world.

It appears he could have cheated people out of $70 million or more. I wasn’t immune either; he took me — his friend! — for $1.75 million when we (or so he told me, anyway) bought a Stingel copper cast together with another partner.

As all of this came to light, last November, he vanished.

As an art dealer, he had few rivals, from his generation or beyond. He had an uncanny knack for finding the very best examples of a select group of artists who were in demand (or would soon be) and knowing the minutiae of those markets better than anyone I’ve met. It was his facility for finding great examples of highly sought-after art, and the well-endowed homes and art storages to park it in, no matter how temporarily, that attracted the deep-pocketed, from Jopling to a coterie of the young, privileged, and entitled.

Here’s how it worked: Philbrick made his money betting big on a rise in price for a few artists, notably Stingel, who is known for his seemingly endless series of indistinguishable paintings of wallpaper (I’m not kidding, though I admit to liking them), and Wool, whose most famous text painting fittingly spells out the word FOOL. It worked so well for a while — Stingel’s prices went as high as $10.5 million in May 2017 — that he called himself “Stingeldamus.”

Philbrick had a close-knit group of friends and supporters he regularly traded with who were steadily driving up prices from one deal to the next. Often it was “secondary market” works (what car dealerships might call “pre-owned”), since galleries in various ways make it difficult to buy works of coveted “primary market” art (art that has not been previously sold, sometimes hot off the easel) by giving early access to their established collectors. These are people trusted not to flip the art and instead play along to the subtle and incremental holding game lest its value shoot up unsustainably quickly and then deflate. In practice, this often means that only insiders can reliably make money in an art market.

Sometimes you’d have to do clever things to get access. Philbrick would use a network of art advisers and proxies — even actual actors playing an art-interested version of their recognizable selves to starstruck gallerists — to buy works that might not be for sale directly to him, only to flip them.

The flip is what mattered, the prices going ever higher. If this sounds like the condo market in Miami Beach in 2007, there’s a reason for that.

The art market was estimated at $64 billion last year. But the value of art in existence is much more. Art is an asset class, but one that offers no dividends or income by hanging on the wall or, as is so often the case, being jammed into Fort Knox–like storage facilities in places like Geneva, designated “free ports” that function as government-sanctioned holding pens where, if the art is never hung on the walls, the owner doesn’t have to pay taxes on it. There it sits, hopefully maturing in value like a vintage wine. (There’s also wine and even cars parked in these facilities.)

How do you take advantage of that? The past decade has seen an avalanche of banks and finance companies offering easy credit collateralized by fine art and spurred by low interest rates and the highly publicized spike in art prices. Basically, you’d borrow against your holdings and do what you could to ensure that the values rose, including selling off shares of the artworks and teaming up with others to spread the risk of artificially bidding up the prices.

With the greater expansion in the global art market in the past 25 years, things soon got a little too easygoing. Lenders once mandated that art collateral be held in neutral storage facilities they controlled, but over this time the requirements were loosened and borrowers were allowed to hang on to the art, giving some the opportunity to unscrupulously deal it (or to borrow more against the same collateral), supposedly to contribute to paying back the initial debt.

The art world is to some extent unregulated and not particularly transparent. There is no centralized database of artworks’ ownership and nothing resembling title with regard to a work of art, as with real estate and cars (other than when there’s an outstanding loan and a creditor chooses to file for protection under local Uniform Commercial Code statutes, which means some lenders in jurisdictions that permit it can file a searchable lien against a painting or sculpture). Consequently, prices sometimes can be manipulated by the very well connected, who would be consistently selling and reselling the same works at increasing prices to an unwitting clientele or choreographing the selling of those works at auction to give the impression of ever-rising value. It’s easy to think you can mastermind this, and in various ways you can, but since nothing goes up forever (in a straight line, anyway), your big bet can rather quickly become as overleveraged as WeWork. Stingel’s prices went up through 2017 but then began to fall. As ARTnews put it in December of last year, “a torpid Stingel market was a threat to Philbrick’s business strategy, as it began to shut off the supply of new money,” though he profited handsomely on the way up.

You can partly credit, or blame, the election of Donald Trump for this. In a more woke art world, the group of white male artists Philbrick dealt in, after experiencing meteoric rises, began to plateau and tumble. Meanwhile, the prices of some artists of color skyrocketed. Rather than rein his bets in, Philbrick seemed to grow ever more audacious. There is an adage with which my father frequently admonished me as a child: You can lie as much as you like, but don’t believe your own lies.

Philbrick bought more and more expensive works of art at auction, ostensibly to quickly resell them, and played the auction-guarantee game — placing bets on artworks about to be auctioned with a view to pocketing a quick profit (with no money down required to make the wager, like those late-night infomercials encouraging real-estate investments) if they sold for more than the guarantee. But if you guessed wrong or misjudged the market, you ended up with the goods whether you could afford to pay for them or not.

Increasingly, Philbrick got stuck with the art he’d placed wagers on and had to juggle to pay, stealing, as it were, from Peter and Paul to pay Sotheby’s, Phillips, and Christie’s, and he was more than once banned from bidding at auction houses because of late payments — though the houses never admitted to this when his tune was up. No one, in fact, wanted to admit to even knowing him, much less doing business with him, but they all did. Philbrick’s unbridled hubris had a big hand in his implosion, which is slowly becoming apparent still.

I should also mention his penchant for partying. Not only did he drink, he had a hefty appetite for drugs and enjoyed the company of prostitutes. I witnessed all of this (not the hookers, mind you, though I did see phone snaps, I’m afraid to say), and what I did not see firsthand he bragged about to me later. As time went on, it became clear that it might be affecting his judgment. He was rarely, in my experience with him, without a stash of MDMA or ketamine brazenly carried in his briefcase or jacket pocket from one airport to another. He had no fear when it came to being caught with the contraband, or much else. I will never forgive myself (or him) for permitting one of my sons to join him on an Ibiza jaunt where they had a three-night ecstasy bender. And that wasn’t the only time he fed drugs to my kids, which I found out about only afterward. At the same time, he was very supportive of my making and selling my own art and that of my sons, which likely contributed to my turning a blind eye.

His easygoing sense of entitlement was partly bluff, partly something he was bred for. He was born in 1987 in Redding, Connecticut, and his father went on to lead the Pennsylvania Academy of the Fine Arts museum and currently runs Philadelphia Contemporary. His mother is a writer whom he never went into much detail about. His father was selfish and capricious with money, at least according to him. Philbrick once told me he’d supported his mother and sister financially. Though I never saw or had any contact with either woman throughout our relationship.

Philbrick Sr. and son were estranged by the time I met him and rarely, if ever, spoke throughout the time we were close. Although he had studied to be an artist, as a teen he told a friend of his dad’s that he wanted to be an art adviser, an unusual aspiration for a kid (or anyone else). It’s probably difficult to grow up around the very wealthy when you are merely upper-middle class and well educated. He recalled as a child meeting the German artist Jörg Immendorff when accompanying his father somewhere or other; the artist was clad in a full-length fur coat. Philbrick told me he’d sworn to himself that, one day, that would be him. By way of role models, I’m not certain Immendorff was the ideal example: He was arrested in 2003 after being found naked in a five-star Düsseldorf hotel room hosting a little soirée with nine prostitutes next to a Versace ashtray filled with 11 grams of cocaine.

When I met Philbrick, he had a girlfriend, Fran Mancini, an Argentine part-time art dealer and perfumer with short brunette hair; she was from a well-off family, and her mother was in the waste-removal industry. They lived in a modest but art-filled London apartment on Grosvenor Square, a short walk from Cipriani, the Connaught hotel, and Harry’s, the highfalutin haunts where he regularly drank and ate. Though they never married, Philbrick and Mancini had a baby daughter in 2017.

That same year, he began an affair with Victoria Baker-Harber. Mancini and Baker-Harber were acquaintances and vacationed at the same summer rental in Ibiza. Baker-Harber’s nickname for Philbrick was “Fruit,” from his being “forbidden fruit” as the partner of a woman he was having a child with.

Baker-Harber is a sometime cast member on the U.K. reality-TV show Made in Chelsea, in which wealthy young people are shown being bitchy to each other and everyone around them. In other words, it’s a cliché of obnoxious characters in toxic relationships, all striving for vacuous notoriety. It’s not too far removed from the art world these days. (Says Baker-Harber on the show, “Don’t fucking open your fucking fat fucking mouth, you fucking fat turkey.”) But this isn’t her only reality-TV foray; she was thrown off another show for a disparaging remark she’d made about a Hindu castmate, Baker-Harber laughingly told me herself.

Though Philbrick lived large the entire time I knew him, a diamond lodged in the pin of his belt, wearing custom suits and shoes, things seemed to start to go off the rails around the time he hooked up with Baker-Harber. He opened a gallery in Miami, and they spent more and more time there.

The private planes came off multiple contracts for six figures apiece, while the wine went for $5,000 a bottle, drunk at $25,000 tables at clubs from Ibiza to Miami as Philbrick began to follow techno raves by star DJ Marco Carola across the globe like a groupie.

The only night I ever accompanied him in Ibiza, the dinner began at his rental house and ended up at the club Amnesia. Though I tossed the MDMA pill he’d handed me over my shoulder (I’ve never wanted to do a drug that would make me like everyone else; it would ruin my shtick), I managed to get plenty wasted enough to return home at 9 a.m. the following day to my less-than-amused wife, whom I saw while clambering through the bathroom window after being locked out of the bedroom. My family grew to expect such antics after just about every time he and I went out together.

The bravado of drunken backgammon games, with betting at up to $100,000 each, played with wealthy art speculators (or, more often, their offspring) and a bevy of prostitutes, was all part of the program. Philbrick’s, anyway. He once spent a weekend playing checkers with a high-end hooker in a rented villa in Antigua and sent me a picture when I expressed my incredulousness at the very thought — who over 8 years old plays checkers?

Inigo! Inigo! Inigo! Inigo! Each and every morning, the young art dealer would shout at himself at full volume in the shower to fire himself up for the daily dealing tasks at hand. He related this to me endearingly, while Baker-Harber recounted this unusual habit with more than a little alarm. The young man was clearly under a great deal of pressure. Maybe its meaning changed as his elaborate façade fell to pieces. He even had a sweatshirt with INIGO INIGO INIGO printed on it that his girlfriend had made for him.

I refer to the participants who regularly traded with Philbrick and whom he went to exceptional lengths to keep apart — lest we all compare notes and realize what was afoot — as the victim support group of people who got Inigo’d, hoodwinked by the sleight of hand of the art world’s David Blaine. Among the key players were Aleksandar “Sasha” Pesko, a tall, dashing young British investor who bought with Philbrick a share in a Stingel portrait of Pablo Picasso, or so he thought. (It’s not uncommon to jointly invest in a painting.)

This is where it gets a bit confusing: He sold a majority share of a Basquiat to Pesko, then used the Basquiat as collateral for a $10 million loan from Athena Art Finance, allegedly claiming he still owned the entire thing. Around the same time, he sold yet another share of it to another dealer in London, Damian Delahunty. Are you still with me? (I didn’t think so, but you get the idea.) I happened to be the one who informed Pesko of Philbrick’s initial wrongdoing. Pesko went dead quiet when I told him something was amiss; I could practically hear the panic in his silence. I wouldn’t exactly call it a Ponzi scheme but rather a carousel on which the same works were sold or used as collateral for loans more than once. And often more than twice. Not only should the buyer beware but the seller, too! Today, Pesko can express his disdain at Philbrick only in expletive-filled sentences beginning with sleazy and ending with I want to see the MF in jail.

Then there are Andre Sakhai and Victoria Brooks, a pair of collector-investors who, as I understand it, partnered with and bought works from Philbrick repeatedly, as many of us did. Sakhai, a Japanese-Iranian in his mid-30s, is, I was told, the godfather of Philbrick’s daughter, but that didn’t render him immune from the foul play that grew more pronounced as things fell apart, including the outright sale brokered by Philbrick of a work Sakhai had merely asked Philbrick to help obtain a condition report for. When a lawsuit appeared on Sakhai’s doorstep affirming ownership of a work, the full extent of his double-dealing became manifest. Sakhai’s father, Ely, served time in 2005 for selling forged art. Sakhai told me he’d like to get some out-of-work Mossad agents to track down Philbrick.

Brooks is a pixieish, behind-the-scenes art-worlder whose father, David, passed away in prison under suspicious circumstances in 2016 while serving time for insider trading and securities fraud; he’d spent lavishly for her sister’s bat mitzvah featuring performances by 50 Cent and Aerosmith. Works owned by Sakhai and Brooks ended up as collateral for Philbrick loans without their knowledge.

When the art market peaked and began to fall for the artists Philbrick specialized in, the lies became more on the order of psychopathic in lockstep with his increased alcohol-and-drug intake. There were instances of forged bank documents sent to me and others to evidence transfers that were never transferred as well as reports attesting to the condition of various artworks that were as phony as the fake SWIFT (Society for Worldwide Interbank Financial Telecommunication) he concocted. I received such a concocted SWIFT myself and was told of creative-condition reports from a young London-based French collector. The stories of money he owed began to pile up and circulate. The world is small, and the art world is minuscule — and there is nothing the participants like to gossip about more than someone speeding off en route to a horrific crash.

Before the extent of his crimes bubbled to the surface, Philbrick himself related to me the occasion on which he tried to negotiate the sale of a badly damaged Stingel painting from Hiscox insurance company that had been written off owing to catastrophic water damage. An employee of the company confirmed to me that Philbrick indeed had tried unsuccessfully to purchase the damaged painting. Simultaneously, he engaged his assistants to buy the super-rare German paint Stingel uses, which was available only seasonally, so they could replicate over the course of months the precise method of the pricey artist and create an exact replica. Though Philbrick never managed to buy the destroyed work from the insurer — such companies often facilitate or contribute to the restoration of a work that has a claim against it to repatriate it into the marketplace, or they sell it discounted with damage — the fate of Philbrick’s meticulously crafted copy is at present a mystery. Chances are it will be on offer at an auction house near you, if it hasn’t been sold already.

Another scheme (or scam, rather) entailed consigning an Ai Weiwei work entitled Map of China to Christie’s in May 2016 with an estimate of $800,000 to $1,200,000 that was then bid up well beyond expectations to $2,142,000, it turns out by a shell company Philbrick controlled. He then secured financing on the full hammer price — it normally takes one to six months to get paid for art sold at auction — from an investor group led by Ethan Vallarino. After months of radio silence, Vallarino’s calls and correspondence went unanswered, then were blocked, until he finally discovered from Christie’s that the “buyer” had reneged owing to a faint, though not uncommon, scratch on the base of the sculpture and refused to pay. After the finance group filed suit to reclaim the funds advanced on the fictitious sale, Vallarino spotted Philbrick exiting the salesroom at Sotheby’s at a later auction and followed him into a crowded elevator. When the door opened, before he could be collared, Philbrick darted out of Sotheby’s into oncoming traffic and was nearly run over by a taxi. Vallarino and his partners closed down their art-finance company after their Philbrick experience.

The last straw was that Stingel portrait of Picasso he’d already sold, which came for auction at Christie’s in May 2019. His original purchase had been financed by FAP, a German art-investment company; although a percentage of the work had previously been sold to Pesko and then to yet another art investment company. (I can barely sell a painting once!) Philbrick had given forged documents to FAP stating that Christie’s had guaranteed to sell for $9 million, which he subsequently told me was no biggie, lie-wise. Stingel’s painting sold for $6,517,500 that night, far below the amount Philbrick had repeatedly assured FAP it would make. The painting has since been impounded by a judge, and there it remains, embroiled in a handful of lawsuits.

When it came time to pay for the painting, it was at this juncture that Philbrick’s shams in assuming the role of larger-than-life art-world wheeler-dealer came apart, and since then, the claims, lawsuits, and published articles about him have surfaced with nothing short of a tsunami’s force. Not to mention the speculation as to what’s next. Meanwhile, Pesko’s payment to Philbrick for yet a further share of the work he now assumed he owned outright formed the basis of Philbrick’s getaway stash. It was after this time that he absconded.

There are rumors of fraudulent insurance claims and offshore bank accounts in addition to the cases described above; no one yet knows how all this will pan out or what the full scope will be. Though criminal charges have yet to be filed, he’s worth more out of jail to some than behind bars (not the ones he loved to patronize), as the duped investors who desperately want their money back feel it would be easier to negotiate a repayment plan from a civilian rather than a captive clad in stripes. But as the worldwide manhunt continues, the art world ponders what’s next for the slippery and, so far, elusive young dealer.

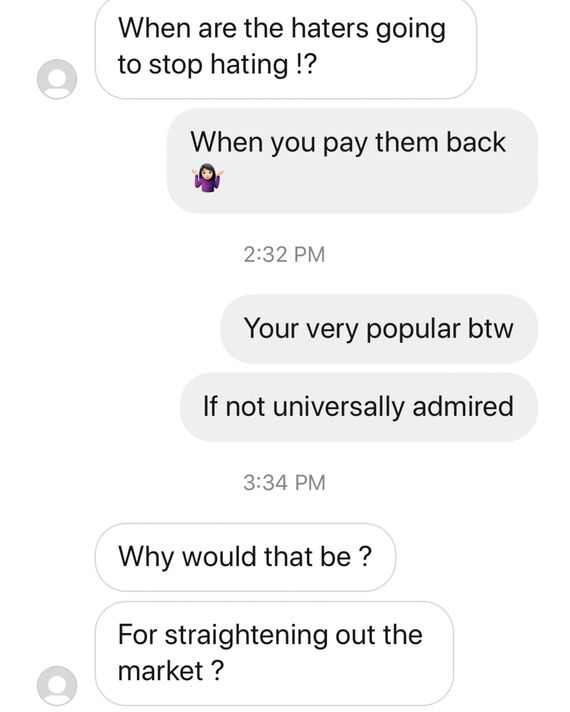

Recently, the FBI is said to have taken an interest. In the meantime, he’s been DM-ing me from multiple fake accounts, offering various self-serving explanations for why none of this mess is of his making. Philbrick’s defenses have grown from diplomatic to progressively more hostile, accusing me of everything from lying and not knowing the facts — everything I’ve told here is from my direct observations or conversations with those defrauded out of millions — to having an agenda and fake Instagram followers, and having confused readers of my regular Artnet column, who will never read me again after the publication of this epic tale.

What gets to me more than the loss of my money is Philbrick’s attitude of denying responsibility, blaming Jay Jopling for his own crimes, stating it was simply a matter of being young and getting in over his head. And, let’s not forget, when his misdeeds came to the surface, he decided to go on an extended holiday to Australia and various surrounding islands (according to several witnesses). As he stated in a DM: “Are you suggesting this was all done alone?” And besides, it was “just regular art dealing like everyone else.” Worse, and more alarming, was his observation that the people he screwed “shouldn’t have been in the game in the first instance.” When I asked how he could so nonchalantly forge loan documents and auction-house agreements, he replied that art lenders “own to lend and lend to own,” whatever that means.

Because of a really good run from 2012 to 2015, I might have overlooked being taken to the cleaners for a few million by my dear “friend.”

Even as his lies began to snowball from run-of-the-mill art-world sketchy to cartoonish, I kept coming back to the fact that he undoubtedly cared an awful lot about art and knew more about the artists he championed than just about anyone else did. Certainly, no one of his generation came (or comes) close. Have I learned anything? For one thing, a year ago I stopped drinking. Still, to this day, I catch myself reaching for the phone to seek his advice.

Among his last remarks to me on Instagram were that this has “died down and everybody has moved on” and he will “be back this time only bigger better stronger wiser and fitter.” All this despite undefended lawsuits being filed against him by the bushel.

Another recent faux account went after my kids, asking them if they weren’t embarrassed by my actions (clearly, they’ve grown used to the condition of being mortified by me over the years). In his own words, I am “a joke,” he feels “sorry for my family,” and I made “a fool out of my wife”!

This is a far cry from the Philbrick I last saw when we walked in circles around a couple of square blocks in New York City on the eve he went missing (the thought occurred to me that he might be wired by the Feds) and confided in me his “crimes” of embezzling money through forged loan documents and selling works to multiple parties. He showed regret and contrition, if only for a fleeting moment. That was the first and only time I’ve known him to act humbly — and that mind-set has clearly deserted him since. He’s now back to his foolishly overconfident self (he had been in hiding with Baker-Harber in an apartment in Sydney she inherited from her grandmother, though I was told he has since left), and instead of bragging about his unflagging genius, he’s raging that he didn’t do a damn thing wrong, only behaved like every other art dealer.

After a piece came out last week in the Times about him, I was DM’d by another account, inspector_barker. We soon began to argue over his treatment. “Ever heard of the phrase ‘token villain,’ ” he DM’d. “Easy to have the young innocent guy as the scapegoat rather than the experienced pros who won’t make you popular if you castigate them.” This was too much: I responded, “Reality test. Inigo inigo inigo look hard in the mirror.”

I remember around Christmas, I was contacted via DM by Steve_Irwin, the Australian naturalist who died from a pierced heart after he was impaled trying to film a stingray, an animal he had devoted his life to preserving. I became convinced that this was Philbrick as well. The symbolism of using a figure analogous to Saint Sebastian, a martyr who suffered multiple arrow wounds in defending his religion, was clear, though perhaps it was lost on Philbrick that Sebastian was later clubbed to death.

*This article appears in the March 16, 2020, issue of New York Magazine. Subscribe Now!