In this week’s Buffering, we break down Peacock’s (deliberately) muted premiere and take a look at why some TV development execs are busier than usual during the shutdown. Plus, we kick off a new feature looking at some lesser known streaming choices worth checking out while we’re all staying in. Enjoy, and stay safe.

What Slowdown?

Nobody is filming any scripted TV shows right now, but that doesn’t mean Hollywood has gone into hibernation during the COVID-19 pandemic. While it’s still anyone’s guess when (or how) production resumes, I’m hearing from agents and insiders at streaming networks that there’s actually been an explosion in behind-the-scenes dealmaking during the Great Shutdown — at least at some platforms. “Everybody is trying to set up projects,” one streaming staffer told me. “Everybody’s doing Zoom pitches like crazy and making new deals.” A veteran agent echoes that assessment: “At a time where there are no in-person pitches, we are selling a ton,” he says.

So what’s going on? Insiders suggest the pitching frenzy is about platforms wanting to be prepared for whenever it becomes safe to start shooting again. While the big cable and streaming platforms all have a decent-size stockpile of new shows sitting on the shelf for later this year, the production pause could become evident several months later in 2020 or in 2021, when the number of new and returning show premieres is noticeably reduced. In theory, buying pitches and greenlighting projects now allows writers to start building a library of scripts ready to be filmed whenever production resumes. The same is true with having writers on existing shows get to work now on future seasons.

“This is a chance to finally get ahead of the curve,” one exec explains, noting that TV productions are forever playing catch-up, with scripts sometimes not finished until just days before filming commences. (In the case of linear network shows, scripts often get written while shooting of a season takes place.)

Not that buying a bunch of stuff now will ensure a quick return to normalcy. Even though a platform can do a deal for a new show and give the go-ahead for writers to begin cranking out scripts, locking in actors and directors is trickier. Because nobody knows for sure when it will be safe to reopen the soundstages, scheduling production dates with any certainty is all but impossible. That could lead to bottlenecks down the line if the talent a studio or network wants for a project is already committed to something else.

Some broadcast networks may address this by deciding to skip production of pilots for the 2020-21 season and simply ordering their most promising or high-profile projects straight to series, particularly if said projects have big financial commitments behind them. “Networks can’t currently monetize their audience,” one agent tells me, referring to the slew of advertisers who have either pulled their spots from TV or simply don’t have products like movies or toilet paper worth hyping right now. “They’re taking a (financial) hit. And the way they’re gonna save money is that they’re going to dump a bunch of pilots and go straight to series instead.”

One broadcast exec I talked to insists ad revenue actually isn’t down that much (yet) and that any talk of pilots being completely abandoned is premature. He says that once it’s safe to begin filming again, at least a few networks will opt to pilot some projects, even if it’s for midseason or fall 2021. Still, he’s not ruling out the idea that some networks will go straight to series for some projects, particularly those with big production commitments. Don’t be surprised if some of those green lights start flashing by month’s end: Late April is when networks would normally be screening pilots and making decisions on what to order.

Quarantine bluster? It’s worth noting that this surge in activity doesn’t apply to every network or streamer. One cable exec told me he’s not seeing any sort of big uptick in buying right now and suggested some talent reps could be trying to create the illusion of demand (perhaps in order to strike better deals during a time of economic uncertainty). This suit said that because fall and winter schedules are in flux right now as a result of uncertainty over when production will resume, it’s hard to know exactly what projects will be needed. If anything, this source says, there’s actually been less activity of late. A veteran writer is equally skeptical: While networks are ordering more episodes of existing projects, he’s hearing it’s just as hard as ever to get a green-light, “if not harder.”

One reason to suspect the uptick in development activity is real: Because of the unprecedented nature of the shutdown, there’s a very real chance some studios could decide to suspend or even terminate development deals with writers, Deadline’s Nellie Andreeva reported last week. They’d do so by invoking force majeure clauses in contracts, which give employers the right to walk away from agreements due to unforeseeable circumstances. Since a writer who’s working on a viable project with a series order is far less likely to have her deal broken than one who’s simply mulling ideas or waiting to be assigned to a project, there’s plenty of incentive for scribes to take a shot at pitching their best ideas ASAP.

Peacock Pokes Its Head Out

Comcast-owned Peacock unfurled its feathers Wednesday, but don’t feel bad if you didn’t notice. The latest entrant in the streaming sweepstakes is purposely taking a low-key approach to launching: Over the next two weeks, it’ll be rolling out exclusively to the 70 percent or so of Comcast’s 31.5 million customers who have access to its Xfinity and Flex products. Everyone else will have to wait until Peacock’s planned national premiere on July 15 (though that date may be moved up, as we first reported last month). The slow start was planned long before anyone had heard of COVID-19, but given how much the pandemic has upended everything, it’s probably not a bad thing Peacock is hatching slowly.

For one, launching in phases lets Comcast lower expectations. Beyond accepting terms and conditions and confirming an email address, the first batch of users won’t even have to actively do anything to get Peacock; it’ll just show up at no additional cost as part of their Xfinity cable or Flex internet packages. Quibi has had to deal with analysts debating whether or not its 1.7 million downloads in week one is a great thing (or meh, because it’s no Disney+); HBO Max will face similar scrutiny in the weeks following its debut next month. It’s unlikely anyone will be paying as much attention to how many users or subscribers Peacock has in its early months. And because nobody is paying anything for Peacock right now, any complaints about the service, such as outages or content availability, will likely be muted.

The Peacock “preview,” as Comcast is labeling it, also gives the company time to learn about consumer behavior and how early adopters are interacting with the service. The Xfinity customers will be like a giant focus group, giving Peacock execs insight into what parts of the offering are most popular with customers and what’s not clicking, and allowing them to fine tune their product ahead of the national debut. Plus, if there are any major bugs in the product, Peacock will have some extra time to squash them before it opens up the service to paying customers.

So how’s it going so far? Your Buffering correspondent isn’t in a Comcast market, so I haven’t been able to check out Peacock in-person yet. A video presentation I watched, however, suggests the user interface is clean and relatively intuitive. It’s certainly much spiffier than the woefully outdated Amazon Prime Video experience and seems far less clunky than Hulu. Peacock also has a simulated TV experience, where you can scroll through a program guide and watch virtual “channels” devoted to specific themes or shows (like Saturday Night Live). It’s nothing Pluto, Tubi, or STIRR haven’t been doing for years, but it’s nice to see a big company such as Comcast put its spin on the concept.

One thing some Peacock users will hate: Like Netflix, trailers for individual shows are set to autoplay, so as you’re scrolling through content tiles, promos for the show or movie will start to play. Interestingly, while Netflix recently made it possible for subscribers to turn off those automatic trailers, a Peacock rep says the Comcast platform will have no such option. That’s not a shock given most Peacock users will likely get the service at no additional cost beyond their cable bill. (There will also be a stripped-down Peacock for cord cutters that will be free.)

What Peacock is saying: During a telephone press conference Tuesday, Peacock chairman Matt Strauss conceded the pandemic has already had an impact on what the service will be offering consumers during its first few months. Beyond the lack of Olympics-theme programming in summer now that the Games have been delayed, Peacock’s plans for a rich roster of originals will now be much slimmer early on because so many had to halt production. A new take on Brave New World “is essentially done,” Strauss says, while reboots of Saved by the Bell and Punky Brewster should be fine, too. (The first teaser trailers for the shows, plus a new Psych movie dropped Wednesday.) The exec sought to put a positive spin on this development by noting Peacock’s extensive library of older movies and TV shows and citing research indicating audiences are looking for comfort-food TV right now, as well as shows they can watch together as a family. “This cultural moment plays to our strength,” he said.

While it’s hard to find any legit silver lining in a pandemic playbook, I don’t think Strauss’s professed optimism is all that divorced from reality. Sure, Peacock will face the marketing challenge of launching in a crisis, same as Quibi or HBO Max. And as I noted last month, not having the Olympics as a promotional platform is a major loss for the service — period. (Strauss noted that rescheduling the Games until 2021 means there’ll be two Olympics on Peacock within the space of around six months, which is true — but doesn’t change the reality that he’ll have to hustle harder to get viewers during the platform’s critical first year.)

The case for Peacock: The argument for the service still being okay in all this is that the platform isn’t depending on subscription revenue as its chief revenue source. While non-cable subscribers will be able to pay to get access to a premium version of Peacock, and there’ll also be an ad-free version for a cost, anyone with a broadband connection will be able to stream the basic Peacock service at no cost. Given how many millions of Americans have lost work in recent weeks, and the likelihood a recession could drag on for months, coming to market with a free video offering featuring a rich catalogue of familiar faves seems like a pretty good thing. Early advertising revenue could take a hit, of course, but because Peacock is part of the broader NBCUniversal media empire, it’s not out there on its own trying to line up sponsors. So while I don’t think Peacock is going to cause anyone at Netflix or Hulu to lose any sleep, it has a good shot at accomplishing its main mission: getting audiences now watching NBCU broadcast and cable shows on linear TV to do so via the company’s own streaming service.

Looking to Stream Something Different?

The glass-half-full take on the COVID-19 lockdown is that, unlike in 1918, most Americans trapped inside during this pandemic have the option of streaming countless hours of TV via the deep programming libraries of Netflix, Hulu, Amazon Prime, or Disney+. But not all the good stuff can be found on the big streamers. There are dozens of niche players and smaller platforms that serve up some truly great programming, often for $5 per month or less. And right now, some are even offering extended trials of up to 30 days, allowing consumers the ability to take their time exploring. For the next few weeks, I’m going to highlight at least three lesser-known streaming options worth checking out. I haven’t spent quality time with every one of them, so think of these as suggestions, not recommendations. And if you have a smaller streamer you really dig, send me an email and I’ll try to check it out. Here are this week’s choices:

Night Flight Plus

The digital reincarnation of the groundbreaking 1980s music and culture TV series serves up a deep library of amazing artifacts from the 1970s-1990s, and the variety is impressive. Beyond a selection of complete episodes, you’ll find everything from midnight movies (Desperate Teenage Lovedolls, I Was a Zombie for the F.B.I.) and music docs (Life on the V, Heavy Metal Parking Lot) to full episodes of Gumby and Dr. Ruth’s syndicated talk show.

Cost: $5 per month/$40 annually.

Shout! Factory TV

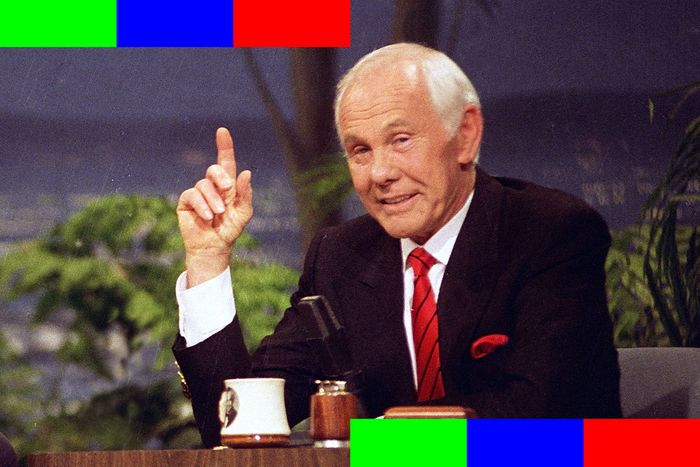

The much-loved indie DVD (and, back in the day, music) distributor has put much of its video library online, serving up a great assortment of 20th-century cult TV shows and movies. Tentpole titles include Mystery Science Theater 3000 and old episodes of The Tonight Show Starring Johnny Carson (sadly, minus musical guests), but where the service shines is with smaller gems such as the Dean Martin Celebrity Roasts, The Weird Al Show, Fridays and Space: 1999.

Cost: Free with ads, or you can get an ad-free experience for $2.99 per month via Amazon Channels or Roku. (Find out all the options and platforms here.)

Acorn

An Anglophile’s best friend, Acorn caters to audiences who want (much) more British programming than you’ll find on PBS or BBC America, along with a decent-size serving of shows from Australia, New Zealand, Canada, and France. Its lineup has some big hits (A Place to Call Home, Midsomer Murders, Murdoch Mysteries, and Doc Martin), plus exclusives such as Miss Fischer’s Murder Mysteries, Dead Still, and Agatha Raisin.

Cost: $6 per month/$60 annually. Right now, Acorn is offering a free 30-day trial with the promo code FREE30.